Community AMA Recap

- pavel0016

- 6 days ago

- 5 min read

Updated: 5 days ago

On January 23, we hosted our very first AMA session of 2026 – Community AMA: Road to 2026 and the Team Behind It.

This time, COCA’s leadership team joined live on camera, giving the community an opportunity to see and engage directly with the people leading the product and shaping its direction. This marked an important step in strengthening transparency and connection with our community. We shared our plans for the year ahead, gave a first look at how upcoming app updates will look, and answered your most asked questions.

And honestly, the questions were great. Thoughtful, sharp, and clearly coming from people who really care about where COCA is going.

Thank you to everyone who joined the AMA, and congrats to the 5 lucky community members who received rewards for the most interesting questions.

If you missed the AMA session, no worries, we’ve put together all the key highlights in this blog post. Enjoy the read!

🏦 COCA Vision: From Wallet to Self-Banking

The AMA opened with COCA’s core idea for 2026. The team shared a clear direction: COCA is evolving from a crypto wallet into a new-generation challenger bank.

The goal is simple. Users should fully own their money, earn on their balance, and stay in control at all times. COCA is building a banking experience where the card is non-custodial, rewards are transparent, and value flows back to users instead of traditional financial institutions.

🚀 Key Product Updates Coming in 2026

Apple Pay

Following the launch of Google Pay in November, COCA will launch Apple Pay within the next few weeks. Users will be able to pay with their COCA Card online and offline anywhere these services are supported. Physical cards can be added to Apple Pay instantly by tapping an iPhone.

Self-Banking and Non-Custodial Accounts

One of the biggest updates in COCA’s history is the move to self-banking. Each user will have a fully on-chain, non-custodial smart contract account using account abstraction. Only the authorized amount is processed during payments, and COCA cannot access or block user funds.

Bank Accounts

COCA will introduce real bank accounts with support for SEPA, SWIFT, USD, and EUR. Users will be able to receive salaries, make bank transfers, and withdraw funds like with a traditional bank, while keeping full financial sovereignty.

Instant APY

Instead of waiting for monthly rewards, users will earn APY in real time. Funds will generate yield instantly through integrations with Morpho, with risk management reviewed by Gauntlet. The focus remains on sustainable and secure returns.

In-App $COCA Buy and Sell

Users will be able to buy and sell $COCA directly inside the app, without third-party exchanges. Transactions will work directly from the banking balance with competitive rates.

Card-to-Card Transfers

Simple card-to-card payments will allow users to send money instantly to friends and family, making transfers feel as easy as sending a message.

Global Expansion

COCA is expanding to new regions, including the United States. USD accounts, local payments, and broader market access will make COCA a truly global product.

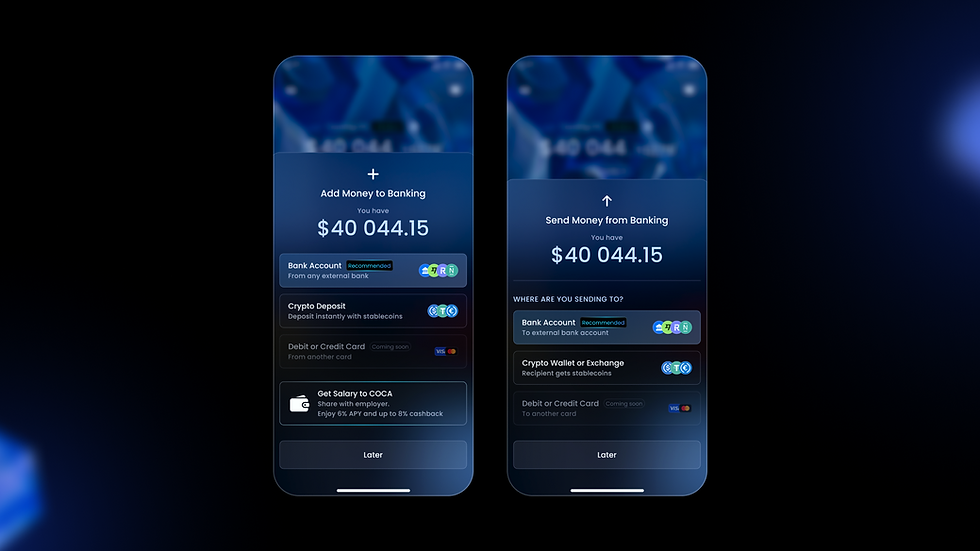

📲 App Demo Highlights

The team also shared a preview of the new app experience, including:

Login without seed phrases using email and OTP

A new “Banking” home screen

Separate USD and EUR accounts with full transaction history

Real-time APY tracking

Easy top-ups via bank transfer, card, crypto, or salary payments

Simple withdrawals to bank accounts, cards, or external wallets and exchanges

The app shifts focus from crypto-first to a full banking experience while keeping crypto functionality available.

🪙 Tokenomics and $COCA Updates

The team shared important updates about $COCA tokenomics, focusing on long-term sustainability rather than short-term speculation.

Key points:

Allocation freeze: No new tokens will be unlocked in the market until December 1, 2026

Extended team lockups: Team tokens locked for up to 10 years

Tier-based utility focused on participation and real product use

Future buyback and burn mechanisms, tied to product growth and revenue

Transition to USD-based tier pricing to keep tiers accessible as the token price changes

$COCA is positioned as a core part of the ecosystem, not a hype-driven asset.

👥 Support Improvements

COCA shared plans to significantly improve customer support:

Live chat for faster communication

AI-powered assistance to guide users and speed up resolutions

Expansion of the support team for better global coverage

Clearer internal workflows and escalation processes

The goal is faster, clearer, and more reliable support at scale.

💬 Community Q&A

During the AMA, the team answered some of the most popular questions submitted by the community. Below are the key questions and short summaries of the answers.

Will COCA be available in the US, Canada, Uruguay and Africa?

Yes. With the transition to self-banking and a non-custodial infrastructure, COCA will be able to expand to more regions. The US and Canada are part of the upcoming plans, while availability in parts of Africa (Nigeria, Ghana, Kenya) is already live and will continue to expand. Uruguay is expected later in 2026.

Will COCA provide downloadable transaction or card statements for tax reporting?

Yes. COCA plans to introduce downloadable card and transaction statements in Q1–Q2 2026 to support tax reporting and compliance needs in different countries.

Will COCA provide downloadable transaction or card statements for tax reporting?

Yes. COCA plans to introduce downloadable card and transaction statements in Q1–Q2 2026 to support tax reporting and compliance needs in different countries.

Under DAC8, will COCA report user transactions to tax authorities?

No. As a non-custodial and self-banking solution, COCA is not required to automatically report user transactions under current regulations. The team will continue to monitor regulatory changes closely.

How will the upcoming non-custodial card work, and which assets will it support?

Each user will have a smart contract account based on account abstraction. Only authorized amounts are processed during payments, and COCA cannot access user funds. At launch, the card will support USDC, USDT, and EURC across 10+ major networks, with more assets and chains planned.

Will COCA eliminate gas fees to match the experience of a traditional bank?

Yes. COCA plans to cover gas fees for banking-related operations such as deposits and withdrawals. Additional gasless features for crypto wallets may be introduced later, potentially depending on user tiers.

Are there plans to support BTC deposits or borrowing using BTC as collateral?

Yes, this is on the roadmap, but it is not a short-term priority. The team already has potential partners and plans to let the community influence the decision through future DAO voting.

Will COCA partner with more DeFi protocols to offer higher yield?

Yes. The initial integration will be with Morpho, supported by Gauntlet for risk assessment. The team is actively monitoring other DeFi protocols and may add more yield options as long as security standards are met.

Are business accounts or corporate cards planned?

COCA is exploring this direction, but the current focus is on delivering and refining banking features for retail users first. Business accounts may come later.

How sustainable is COCA’s cashback model in the long term?

The model is based on efficient infrastructure, merchant offers, and DeFi incentives. Cashback and yield are not paid directly from COCA’s revenue, making the system more scalable and sustainable long term.

As the token price grows, how will COCA keep tiers affordable?

COCA plans to move tier pricing to a USD-value model. Tiers will still be unlocked using COCA tokens, but their cost will be pegged to a fixed USD value. This means the number of tokens required will adjust automatically based on price, keeping tiers accessible regardless of token price fluctuations.

Will COCA support more stablecoins and currencies in the future?

Yes. Additional stablecoins, currencies, and blockchain networks are planned for 2026. The team will also use community polls and feedback to prioritize new assets.

🙏 Looking Ahead

Once again, thank you to everyone who joined the AMA session and took the time to read this blog post.

We plan to host these sessions regularly to stay closer to the community, gather feedback, answer important questions, and continue building the product together with our users.

Team COCA 💙

.png)

.png)

Comments